Final vote on funding to come in lame duck session in January

SPRINGFIELD — On the final day of their fall veto session, Illinois lawmakers on Thursday advanced a pair of bills that would infuse $1.8 billion into the state’s unemployment trust fund, which was depleted during the economic shutdown brought on by the COVID-19 pandemic.

The bipartisan agreement came together after more than a year of negotiations between business and labor organizations, the governor’s office and lawmakers from both sides of the aisle.

Without the package, the state unemployment insurance premiums charged to employers would have skyrocketed over the next several years, likely coinciding with a reduction to benefits paid to unemployed workers who are covered by the program.

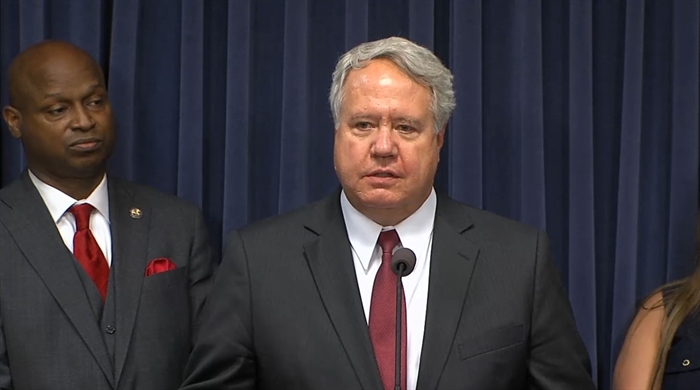

“As everyone knows, as a result of the COVID pandemic, there was a historic amount of unemployment here in Illinois and the rest of the world,” Rep. Jay Hoffman, D-Swansea, said while explaining one of the bills.

That drove the fund from a surplus exceeding $1 billion to a deficit of $4.5 billion at the height of the pandemic.

“So, ultimately, we had to figure out what we were going to do,” he said.

Illinois, like many states, was able to borrow the $4.5 billion from the federal government to keep the unemployment insurance program going during the pandemic, but that debt had been accruing interest at a rate of 1.59 percent.

In March, lawmakers approved $2.7 billion from federal American Rescue Plan Act funds to pay down the balance. And in September, after the unemployment rate had returned to normal levels, the state made another $450 million payment out of program-related revenues. That brought the balance due to just under $1.4 billion.

The plan now moving through the General Assembly calls for using excess revenues the state has seen this year to pay off the remaining $1.37 billion owed to the federal government, plus another $450 million in the form of a zero-interest loan to the trust fund that is to be paid back over the next 10 years.

In order to generate the money to pay back that loan, employers will see an increase in the amount they pay into the fund in the form of insurance premiums. But even with that, officials said, they will see a $915 million savings compared to what they otherwise would have had to pay if no deal had been reached.

Two bills were necessary to execute that package. House amendments to Senate Bill 1698 authorized the structure of the program. It passed both chambers on Thursday by wide margins: 95-8 in the House and 45-8 in the Senate.

A separate bill containing the actual appropriation, an amendment to Senate Bill 2801, cleared the Senate, 46-9.

But due to procedural rules, the House was not allowed to vote on it immediately. Instead, the lower chamber is expected to take up the bill during a lame duck session tentatively planned for the first week of January.

Capitol News Illinois is a nonprofit, nonpartisan news service covering state government. It is distributed to more than 400 newspapers statewide, as well as hundreds of radio and TV stations. It is funded primarily by the Illinois Press Foundation and the Robert R. McCormick Foundation.