Following successful lawsuits in the fall by national news organizations, the Small Business Administration revealed more detailed information on the Paycheck Protection Program.

The new information included the names of businesses receiving loans under $150,000 and the specific loan amounts for businesses that received $150,000 or more. The loans were granted beginning in April 2020, and applications were approved up until early August.

In total, 1,855 businesses in Champaign and Urbana received $193,622,604 million in loans last year. The goal of the program was to cover lost wages of employees as a result of the COVID-19 pandemic. The loans are forgivable under certain terms.

The SBA had refused to release the detailed information in the fall, citing privacy concerns, although it has routinely released that kind of information – and more – on other loan programs. The Washington Post and other news outlets sued the SBA, and a judge ruled the SBA had to release business names and specific amounts by December 1.

A review of the data for Champaign and Urbana businesses showed:

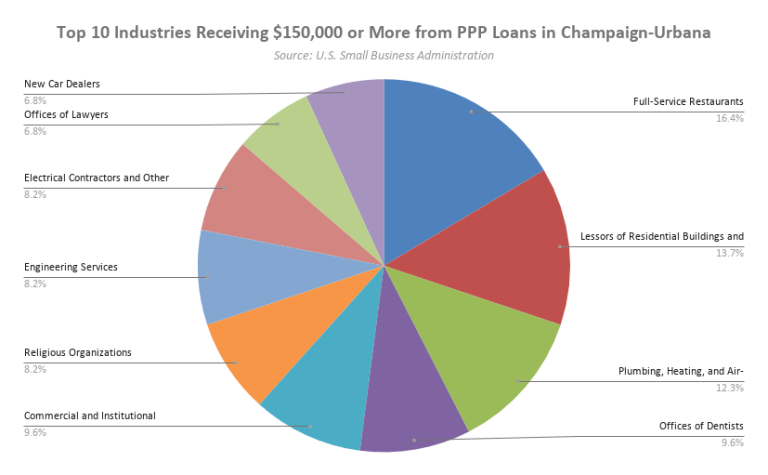

- Loans totaling about $141 million were made to 260 businesses in amounts of $150,000 or more. The median amount of a loan was $312,320 for loans $150,000 or more. The loans ranged from $5,737,300 to $150,000.

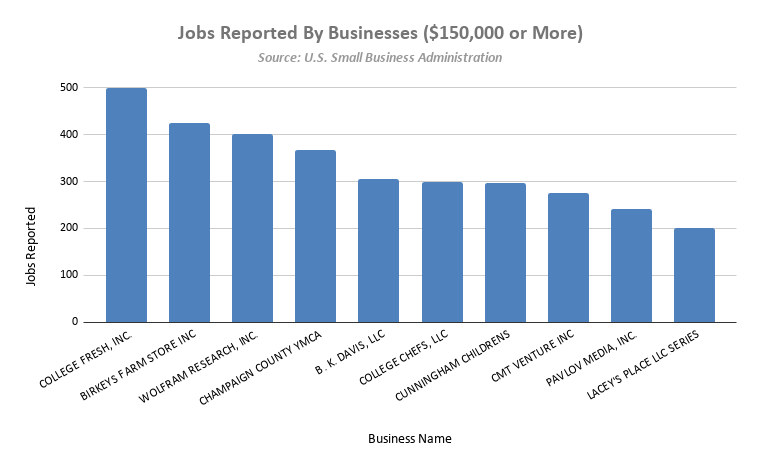

- Those loans were to pay for wages and benefits of around 11,600 employees, as well as cover some other expenses, but nearly 50 businesses reported zero jobs.

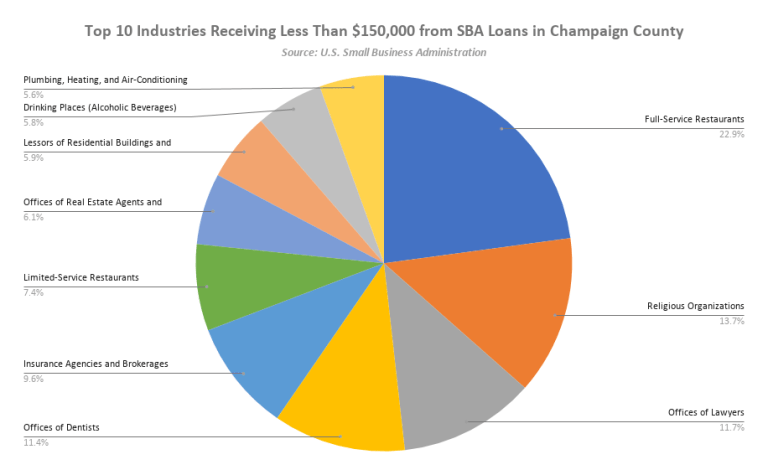

- Loans totaling about $52 million were made to 1,595 businesses in amounts of under $150,000. The median amount was $20,300 and the loans ranged from $149,900 to $350.

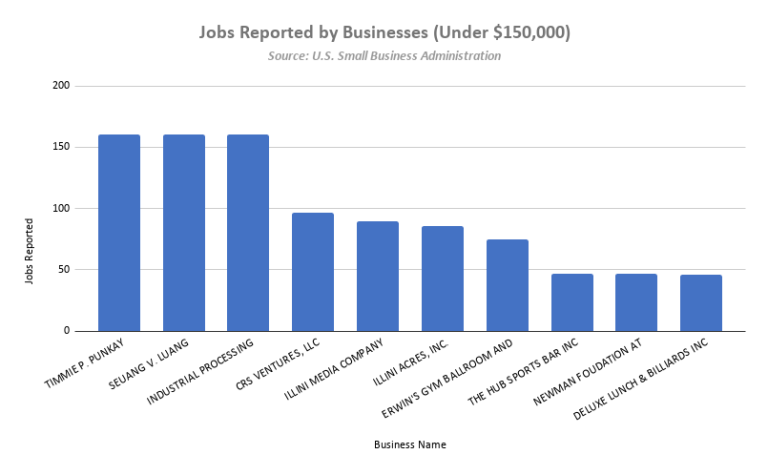

- Those loans were to pay for wages and benefits of around 7,800 employees, as well as cover some other expenses, but nearly 350 businesses reported zero jobs.

Under the program’s rules, businesses can apply for forgiveness of the loans, which were made through SBA-approved lending institutions. Busey Bank gave the most loans at $65,404,831.

The review also showed full-service restaurants, such as C-U Pancake House, received the most money compared with all other industries with a total of $8.2 million in loans. Plumbing, heating, and air-conditioning contractors received the second-highest total at $7.3 million, and software publishers received the third-highest total at $7.2 million.

Full-service restaurants was the industry that received the most loans going to 88 restaurants. Real estate agents received second-most at 72 loans, and beauty salons received the third-most number of loans at 57 loans.

Among the businesses who received $150,000 or less in loans, only about 100 received loans greater than $100,000, and most of the loans were under $25,000.

Restaurants such as Dos Reales and Papa Del’s Pizza were the most common business type to receive a loan under $150,000. Lessors of residential buildings and dwellings such as CPM Management and The Bromley Group were the second most

College Fresh, Inc., which “provides full-scale professional food service management to fraternity, sorority, and collegiate customers,” reported the most jobs, with 500.

The majority of businesses did not answer the category of race for ownership of business within the data, with 248 of the 305 Champaign and Urbana businesses listed as “unanswered” and 50 of the businesses listed the owner’s race as white. Asian-owned businesses got 3 loans and Black-, Hispanic- and Native American-owned businesses got one loan each according to the data for loans $150,000 or more.

Full-service restaurants received the most from SBA loans under $150,000 according to data released December 1, 2020.

Busey Bank, headquartered in Champaign, issued the most loans under $150,000 with 389 of the almost 1,600 loans coming from them. First Federal Savings Bank of Champaign-Urbana and Mattoon-based First Mid Bank & Trust each issued 84 loans.

Timmie P. Punkay, a sole proprietorship that received a $1,500 loan, reported the most jobs, with 160.

Demographically, most businesses were listed as “unanswered” for race and gender data. White-owned businesses had 201 loans, Asian-owned businesses got 31 loans, and Hispanic-owned and Black-owned businesses received 8 loans each, and Native American-owned businesses received 2 loans.

Most businesses did not provide information for gender of ownership.

Certain businesses that previously received a PPP loan may be eligible for a “second draw” loan. The Second Draw PPP Loan applications opened up on January 13, 2021. More information on COVID-19 relief and SBA programs can be found on its website.

CU-CitizenAccess is an online newsroom devoted to community and watchdog reporting by journalism students at the University of Illinois in Urbana-Champaign. Visit online at www.cu-citizenaccess.org